A2 Economics – China and US current account balances

- Trinity Auditorium

- Mar 3, 2024

- 2 min read

Since the financial crisis in 2009 to 2021 (pre-covid), monetary policy has been highly accommodative i.e. low interest rates. Part of the reason for this was that savings were greater than investments – supply of money > demand for money. The current account balance is a good way of looking at a country’s savings status. Current accounts surplus = excess of savingCurrent account deficit = excess of spending

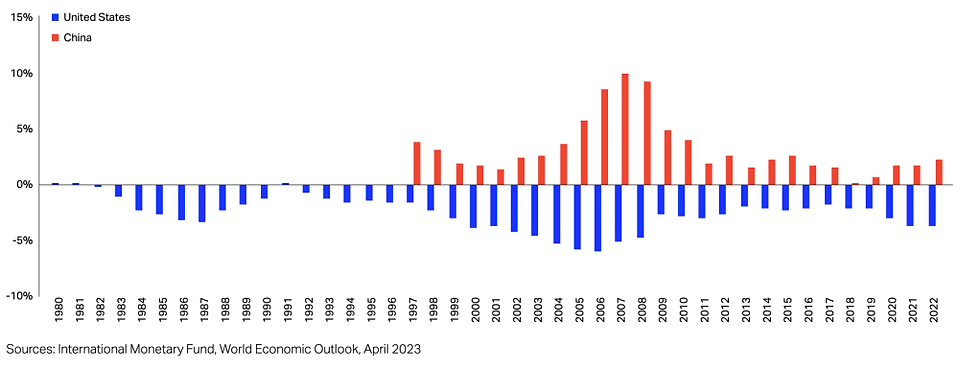

For a long time China has been the lender partially due to its comparative advantage in manufacturing. In 2008 it posted a current account surplus of 10% of GDP but dropped to less than 1% in 2019 – see graphic.

Post COVID-19 it has recovered to over 2% but this figure is indicative of the Chinese economy trying to move away from an export (X) driven economy and rely more on domestic consumption(C). This move is helpful in that big surpluses and deficits can impact global financial stability especially when they beyond 3% of GDP. The US economy has not posted a current account surplus since 1990 which means it has to borrow from abroad and therefore about 25% of its foreign debt is held by foreigners. Japan and China own more than 25% of foreign US treasury securities. You could say that Japan and China lent the US the money to buy their goods. Between 2002-2012 China’s holding of US debt rose from US$100 billion to US$1.3 trillion. Since 2018 it has declined by 30% to US$867 billion. This has helped the 2022 global debt-to-GDP ratio fall by $4 trillion to slightly below $300 trillion although it is still above pre-pandemic levels.

US and China current account balances, % GDP

Countries could find themselves having to compete more for international investors’ funds, contributing to higher interest rates. As the cost of servicing that debt rises, governments almost everywhere will have limited space for fiscal stimulus and a tendency to raise taxes.

What are the 4 accounts in the current account

Balance of trade in Goods – also know as visibles. E.G. Manufactured goods, Semi-finished goods, energy products, raw material, consumer goods and capital goods. The difference between visible exports (+) and imports (-) is sometimes known as the ‘Balance of Trade’.

Balance of trade in Services – Invisibles. E.G. Tourism, Banking, Shipping and Transport, Education, etc. The difference between invisible exports (+) and imports (-) is Balance on Services.

Balance on Primary Income – measures two main flows of income into and out of NZ: the compensation of employess – wages and salaries and investment income – Interest Profits and Dividends coming into NZ from NZ assets owned overseas matched against the outflow of profits and other income from foreign owned assets located within NZ.

Balance on Secondary Income – this includes payments made and receipts received for which there is no corresponding exchange of actual good or service. They include government transfers such as payments to and receipts from international organisations and foreign aid. Transfers by private individuals are also included in this part of the current account – workers’ remittances (transfer of money from people working in a foreign country.

Source: Global Outlook for Air Transport Highly Resilient, Less Robust. IATA June 2023

Comments