Argentina and the practicalities of dollarisation

- Trinity Auditorium

- Dec 13, 2023

- 3 min read

Argentina’s new president, Javier Milei, in his campaign spoke fervently of abolishing the central bank and replacing the peso with the US dollar. Although Milei, a far right libertarian, has some quite extreme ideas there are arguments in support of adopting the US dollar. See video below from Deutsche Welle.

The big concern for the Argentinian government is that dollarisation means the country gives up the ability to influence its own economy through monetary policy by adjusting the money supply. Basically Argentina outsources monetary policy to the US Fed Reserve and interest rates are set at a rate that is applicable to the US economy and not other dollarised countries. Furthermore, the central bank of Argentina would be unable to be the lender of last resort and inject money into the economy.

The October inflation figure in Argentina was 143% with interest rates at 133% – the latter being one of the highest levels in the world. Underlying this inflation problem is how the central bank is trying to reduce the amount of pesos that are in the economy. They issue LELIQS (letras de liquidez) which are short-term bonds that they sell to commercial banks in exchange for pesos therefore taking pesos out of the economy in the hope it reduces the inflation rate. However the problem is that the central bank have to print pesos to pay for the interest of 118% on these bonds, and the national debt of the central bank more than doubles each year. Therefore it is a vicious cycle of issuing short-term bond (LELIQS) to reduce money in the banking system but then having to print money to pay for the interest on the bonds which injects more money into the banking system. The more pesos the central bank prints, the high the inflation and the increasing number of pesos people need to buy food etc therefore deposits in the bank have dropped drastically even with record high interest rates. This also means demand goes up for US dollars on the black market and more scarcity in official markets. The more pesos you hold means the more you lose in dollar terms and therefore increases the incentive to buy dollars with pesos.

Does Argentina have enough US dollars?

One of the main criticisms is Argentina doesn’t have the dollars to do it. At the end of 2022, Argentines held over $246 billion in foreign bank accounts, safe deposit boxes, and mostly undeclared cash, according to Argentina’s National Institute of Statistics and Census. This amounts to over 50 percent of Argentina’s GDP in current dollars for 2021 ($487 billion). Hence, the dollar scarcity pertains only to the Argentine state.

Ecuador and El Salvador dollarisation

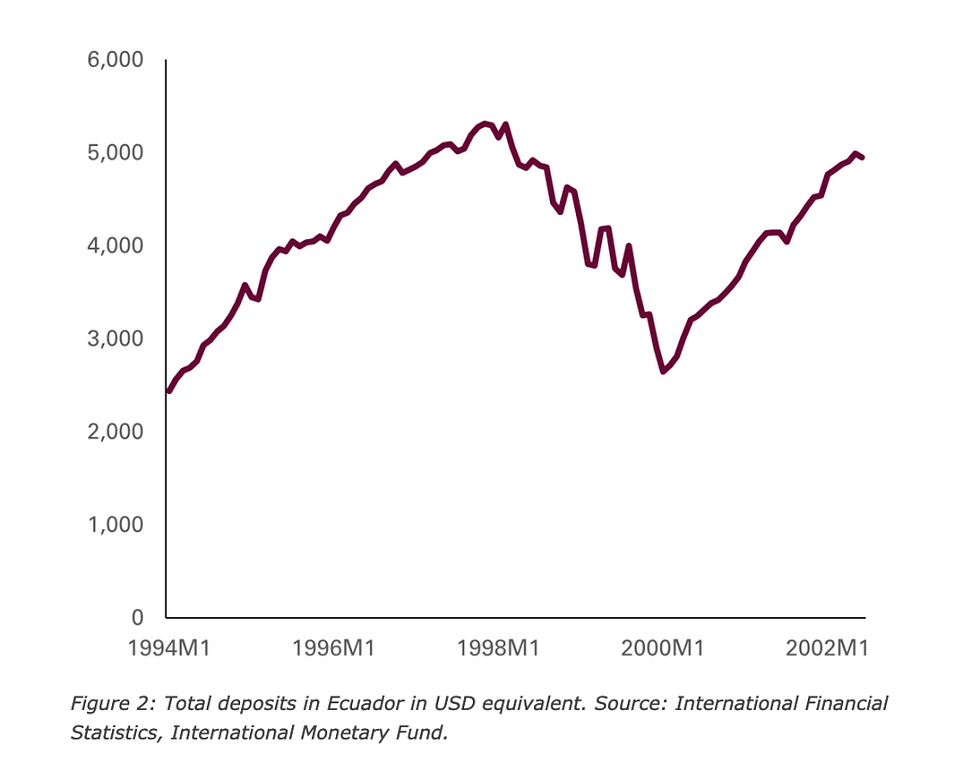

In 1999 Ecuador made the decision to dollarise its economy which basically curbed hyperinflation and helped prevent the sudden slide of the currency (sucre). With dollarisation people bring their dollars into the economy from overseas as was the case in Ecuador. Figure 2 shows how deposits in pesos in Ecuador fell by 50% when measured in dollars from February 1998 to December 1999 and then bounced back exactly when the economy was dollarised, recovering the February 1998 level by June 2002.

As for El Salvador, after dollarising the interest rate fell from 20% to 6% for mortgages, increasing their maturity from 5 to 25 years. El Salvador’s inflation and interest rates have been among the lowest in Latin America for 22 years regardless of the government budget deficit and of international crises, including the 2008 global financial crash and the COVID-19 pandemic.

The experience of dollarisation in Latin American has populations not wishing to reinstate a national currency. The monetary experiences of daily life have taught them that dollarisation’s noticeable benefits far outweigh its theoretical drawbacks.

Sources:

Dollar deliberations DEHEZA – 1-9-23

For more on exchange rates view the key notes (accompanied by fully coloured diagrams/models) on elearneconomics that will assist students to understand concepts and terms for external examinations, assignments or topic tests.

Comments