Credit Multiplier and its limitations.

- Trinity Auditorium

- Nov 27, 2023

- 2 min read

Most economics textbooks that explain the credit multiplier assume that banks automatically expand the credit money supply to a multiple of their aggregate reserves. In the example below the reserve ratio is 25% so credit creation multiplier equals 4 (that is, 1 / 0.25). The figure below shows that loans given by one bank then become a deposit in another bank. Of that $75m deposited 25% must be kept in reserve ($18.75) and the remainder can be lent out ($56.25). This process continues through the banking system. We can also calculate the secondary expansion or credit created using this formula: Credit created equals (1 / 0.r multiplied by the initial deposit) minus the initial deposit.In our example it is $400m – $100m equals $300m.

Although this seems very simple in theory what actually happens is quite different. This focus on fractional reserves suggest that reserve requirements can be a powerful monetary policy tool of the central bank, yet reserve requirements are not currently used in this way:

Banks still make loans with profits, risks and regulatory considerations of which the reserve requirement is not one of those considerations.

Banks first extend credits and then look for reserves

In March 2020 the US Federal reserve technically disbanded reserve requirements by setting the rate at 0%

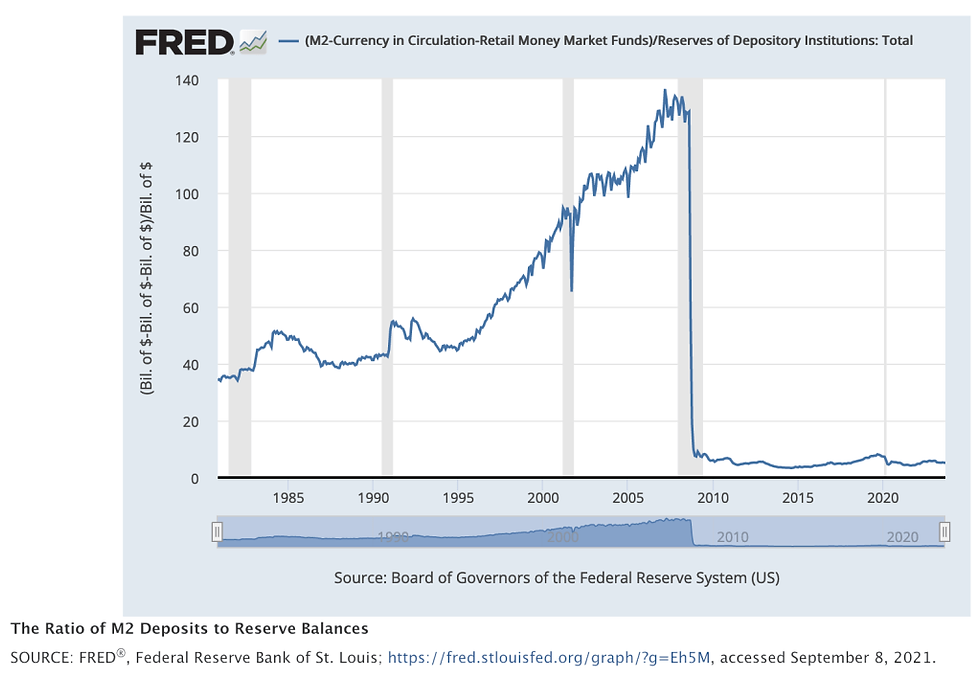

Data shows that even during periods when reserves were limited banks have not been constrained by reserve requirement ratio – see figure below. It shows the ratio of M2 deposits to reserve balances (M2 = total money supply, cash, checking accounts, savings accounts, and other short-term saving vehicles). The ratio should remain stable if the money multiplier concept is valid, but:

1990’s = 40. 2000 = 80. The reason for the change was that banks used technology to shift customer funds overnight from accounts that were subject to reserve requirements to accounts that were not although customers still had access to their funds. Banks therefore were not constrained by reserve requirements.

2007-09 – GFC. Ratio dropped to near zero and reflected as the US Fed injected cash into the banking system to help keep the banking system stable. Moreover, the level of reserves can change significantly as the US Fed try to maintain its dual mandate of stable prices and employment

For all these reasons, educators should shift away from talking about reserve requirements and the money multiplier. Instead, the focus should turn to banks choosing between investment and lending options, with the interest on reserve balances (IORB) rate serving as their reservation rate.

For more on the Credit Multiplier view the key notes (accompanied by fully coloured diagrams/models) on elearneconomics that will assist students to understand concepts and terms for external examinations, assignments or topic tests.

Comments