EVs and the supply chain of minerals

- Trinity Auditorium

- Nov 30, 2023

- 3 min read

The most important component of the the EV in the battery and the global market for batteries is projected nine fold. In 2020 China held over 75% of the global lithium-ion battery cell capacity, and accounts for nearly half of the global lithium carbonate and cobalt refining capacity. Figure 1 shows that the US and EU will only meet around 25% each of the global manufacturing capacity by 2030.

EV market In 2020 sales of EV’s were over 10 million. As well as Tesla the market consists of VW, GM and Toyota as well as Chinese companies such as BYD and Geely. New entrants include Tong from Turkey and Vinfast from Vietnam. In order to remain competitive in the EV market countries have subsidised the industry which is a sort of green protectionism: -China – industrial policy since 2000’s -US – $369bn Inflation Reduction Act – reducing carbon emissions by roughly 40% by 2030 -EU – €250bn Green Deal Investment Plan

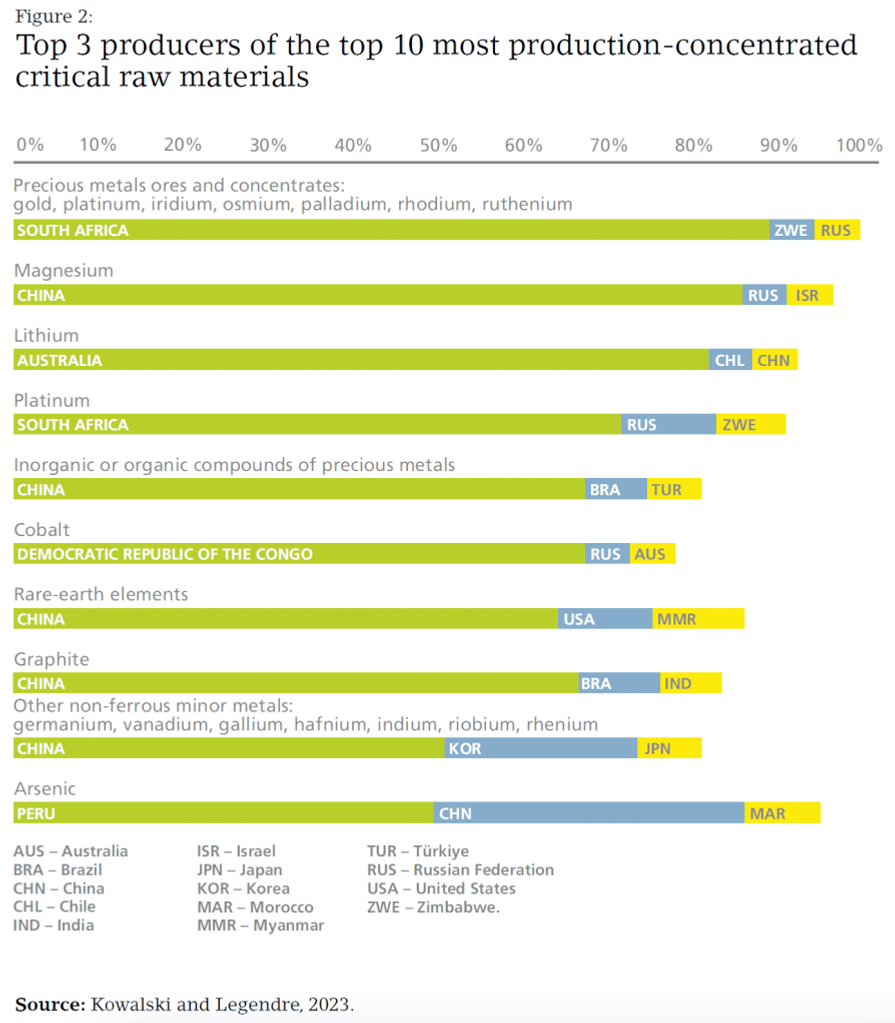

EVs need more mined raw materials Compared to the petrol/diesel motor vehicle today EVs require more minerals in its production. Demand for lithium, nickel, cobalt, manganese, graphites and rare earth elements. With the rapid increase in demand for and constraints on the supply of these materials, prices have increased significantly. Demand for lithium is expected to increase by up to 89 times the current demand by 2050. According to the IEA (International Energy Agency), coping with this extra demand involves long lead times – averaging 16.5 years. Therefore the market will remain quite changeable not forgetting the environmental concerns about extracting more minerals. Those countries that need to import raw minerals for EV production are also concerned about the high concentration of their origin – China, Russia, Australia and African countries being the most prevalent see Figure 2.

Opportunities for developing countries Developing countries rich in these minerals for EVs have a great opportunity to grow their economy’s as production is scaled up. However to take advantage of this it will be vital that developing countries avoid the dreaded ‘resource curse’ a paradoxical situation in which a country underperforms economically, despite being home to valuable natural resources – see previous posts on the resource curse. However, empirical evidence on the resource curse increasingly points to “the importance of strong institutions and capacity to help limit the risk of inefficient and mistimed public investment, and adapt to industry procyclicality, which can foster boom-bust cycles, debt overhang and credit market issues” – B. Jones et al 2023

ESG risks With extraction of natural resources comes environmental, social and governance (ESG) risks EG: – Democratic Republic of Congo (DRC) – environmental damage, child labour, unsafe working conditions, forced replacements of communities. – Chile – lithium production impacts water scarcity in the Atacama Desert, affecting local farmers and communities.

Buyers have been prioritising responsible sourcing – 2018 London Metal Exchange (LME) made it mandatory for all traded cobalt to undergo audit assessments for compliance with the OECD due diligence guidance. This requires strong government frameworks to enforce and promote ESG standards and to decarbonise commodity supply chains.

As mining, processing and manufacturing tend to take place in different geographical locations with different regulatory environments, the challenge is how to navigate such a rapidly changing geopolitical landscape. – B. Jones et al 2023

Sources: ‘The Electric Vehicle Revolution: Critical Material Supply Chains, Trade and Development’ by Benjamin Jones, Viet Nguyen-Tien and Robert Elliott, published in The World Economy in 2023.

Geopolitics and the electric vehicle revolution – LSE – CentrePiece Autumn 2023

For more on Developing Economies view the key notes (accompanied by fully coloured diagrams/models) on elearneconomics that will assist students to understand concepts and terms for external examinations, assignments or topic tests.

Comments