Higher interest rates by US Fed hits developing countries currencies.

- Trinity Auditorium

- May 18, 2023

- 1 min read

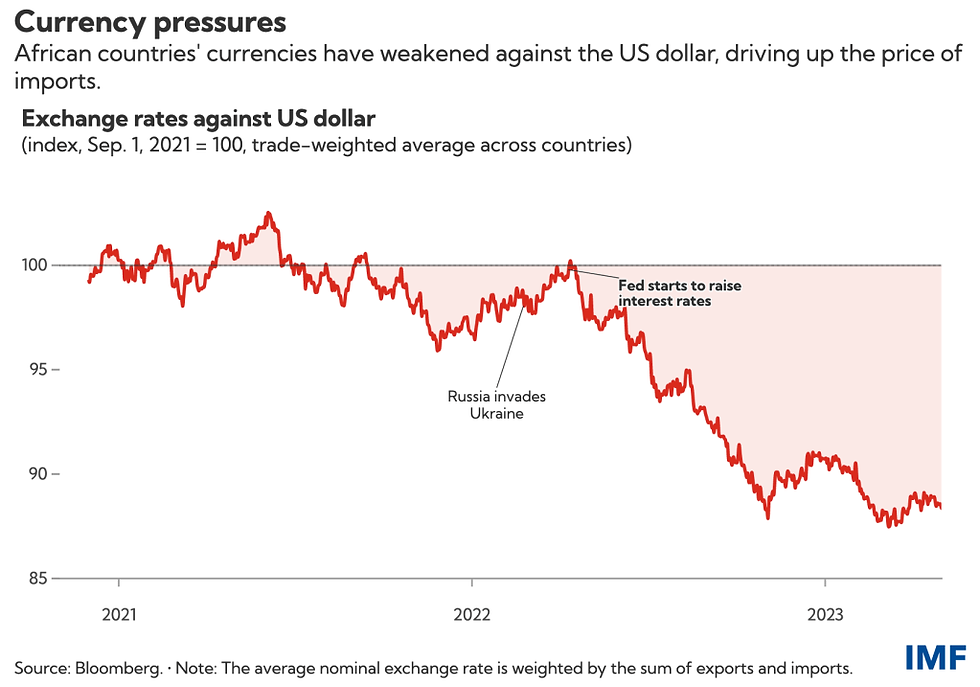

Contractionary monetary policy by the US Federal Reserve to keep inflation in-check has impacted African currencies. With higher interest rates in the US and a volatile global environment investors tend to run to the safety of the US dollar and higher paying US treasury bonds. This has led to a depreciation in African currencies and inflation as import prices increase. For most African countries more that 60% of imports are priced in US dollars and a 1% depreciation against the US dollar = an average of 0.22% increase in inflation.

The graph below from the IMF shows the extent of the depreciation. Two countries’ currencies depreciated by more than 45% – Ghana and Sierra Leone. Some central banks have used their supply of foreign reserves in an attempt to prop up their currencies – giving foreign exchange to importers.

Weaker currencies push up debt – approximately 24% of public debt in most African countries in denominated in US dollars so with a weaker currency they have to find more of their currency to pay back the US dollars. Furthermore, the weaker currency has meant that public debt has risen on average by 10% of GDP in the region. Below is a mindmap showing the impacts of a falling currency.

Source: IMF Blog

Sign up to elearneconomics for comprehensive key notes with coloured illustrations, flash cards, written answers and multiple-choice tests on EXCHANGE RATES that provides for users with different learning styles working at their own pace (anywhere at any time).

Comments