Spending government money to improve wellbeing

- Trinity Auditorium

- Mar 10, 2025

- 3 min read

CentrePiece (London School of Economics magazine) published an article about creating happier lives through government spending. The UK government (Labour) will be allocating around £1trn a year to improving the wellbeing of its citizens. In deciding where the money goes economists estimate the benefit/cost ratios but how do you put a value on non-economic factors that affect people’s wellbeing – such as having a job, better health and low crime rates. UK Prime Minister Keir Starmer has indicated that every pound spent must not be just about national income but also its effect on wellbeing.

Measuring wellbeing in the UK An overview of wellbeing considers change across 59 measures, grouped by 10 topic areas – see below:

The framework combines objective measures, such as unemployment and inflation, with subjective indicators, such as life satisfaction, perceived happiness and hope for the future. They also track well-being performance with a long-term perspective – the sustainability of current trends is measured according to stocks of four capital: human, social, economic and natural.

Estimating the benefits of policies It was often impossible to estimate what someone would be willing to pay – for better health or for getting a job or living in a crime-free environment. By contrast, wellbeing science gives us direct evidence on how such non-income changes affect wellbeing. A new method integrates the impact on income (measured in pounds) with effects expressed in wellbeing years. This is straightforward since we understand how income influences wellbeing years. With this knowledge, we can convert money into wellbeing years or vice versa. The Treasury Green Book advises converting wellbeing years into monetary terms, which is the approach taken in this report. This provides our measure of benefits.

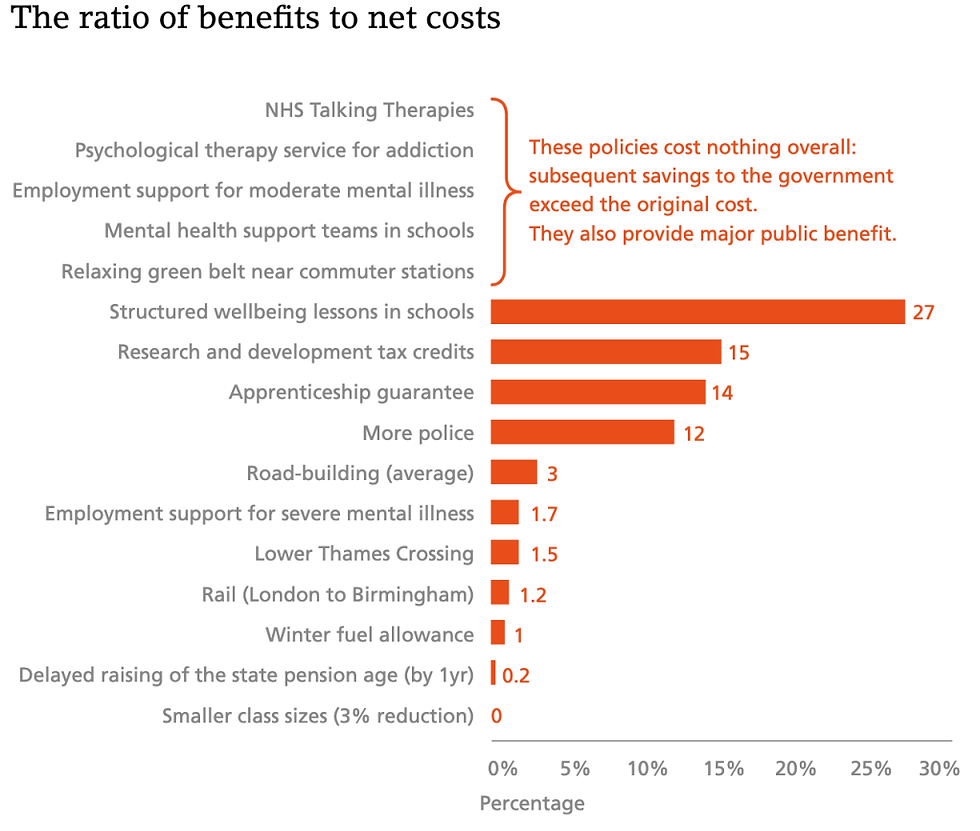

Benefit / cost ratio How much does it cost the government to generate the benefits? For most policies there will be an impact on future government spending. An example used in the article is that treating mental illness now enables many patients to work, paying taxes and coming off benefits. Measuring this they use the following formula: Wellbeing benefits (in £’s) ÷ Net cost (in £’s) or the benefit/cost ratio (BCR)

With the goal is to maximise the nation’s wellbeing policies should be valued by their BCRs. A rational government should implement the higher BCRs first until the budget is set. The most desirable policies are those that cost nothing because they save more thank they cost. NHS Talking Therapies cover anxiety disorders and depression and getting people back into work and off benefit to pay for themselves within two years. Other areas that are not covered by Talking Therapies include addiction to alcohol, drugs or gambling which cause high levels of economic inactivity. A new service would pay for itself with in two years as would mental health support teams in schools.

Of the policies that were investigated four had benefit/cost ratios above 10:1 – see graphic below. For people who do not go to the university, an apprenticeship is the main route to a skill. But there are far too few apprenticeships to meet demand (on the government’s current matching scheme three times as many people want places as the number of places on offer). The effect is a mass of low-skilled workers, low productivity and low pay.

The advancement in the science of wellbeing enables us to effectively implement policies by measuring and estimating their impact on wellbeing and cost. Governments can now scrutinize policies with evidence, however preliminary, on their cost-effectiveness, measured by the ratio of benefits to costs.

Sign up to elearneconomics for comprehensive key notes with coloured illustrations, flash cards, written answers and multiple-choice tests on cost / benefit that provides for users with different learning styles working at their own pace (anywhere at any time).

Comments